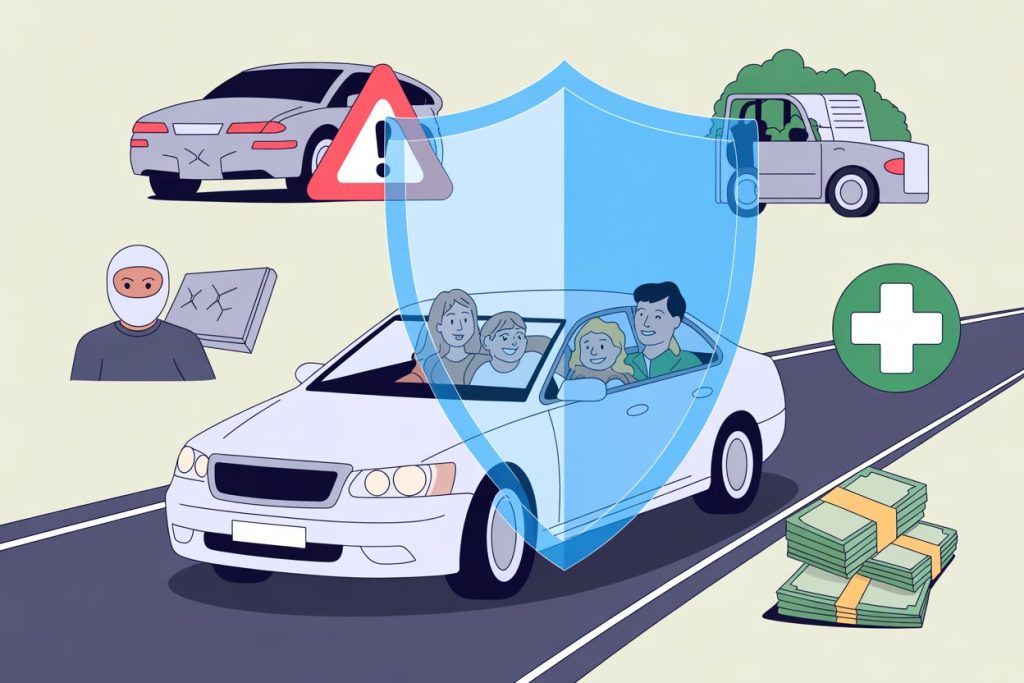

Owning a vehicle comes with responsibilities, and car insurance is one of the most important. Not only is it legally required in most countries, but it also provides financial protection against accidents, theft, or damage.

What is Car Insurance?

Car insurance is a contract between a vehicle owner and an insurance company. In exchange for a premium, the insurer provides financial compensation for damages or losses caused by accidents, theft, natural disasters, or third-party liabilities.

Types of Car Insurance

- Third-Party Liability Insurance: Covers damages or injuries caused to other people or their property. This is mandatory in many countries.

- Comprehensive Car Insurance: Covers both third-party liabilities and damages to your own vehicle caused by accidents, theft, fire, or natural disasters.

- Collision Coverage: Specifically covers damages to your car due to collisions with other vehicles or objects.

- Personal Injury Protection (PIP): Covers medical expenses for the driver and passengers in case of an accident.

Benefits of Car Insurance

- Financial Protection: Reduces out-of-pocket expenses for repairs or medical bills.

- Legal Compliance: Avoids penalties and fines for driving without insurance.

- Peace of Mind: Provides reassurance knowing that unforeseen events won’t cause financial stress.

- Protection Against Theft: Ensures compensation in case of car theft.

Tips for Choosing the Right Car Insurance

- Compare policies from different insurers for coverage and premiums.

- Check for add-ons like roadside assistance, engine protection, or zero depreciation.

- Ensure the insurer has a good claim settlement record.

- Understand the terms, conditions, and exclusions before finalizing a policy.

Conclusion

Car insurance is not just a legal requirement; it’s a vital financial safety net. Choosing the right policy ensures protection against accidents, theft, and unexpected expenses while giving you peace of mind on the road.