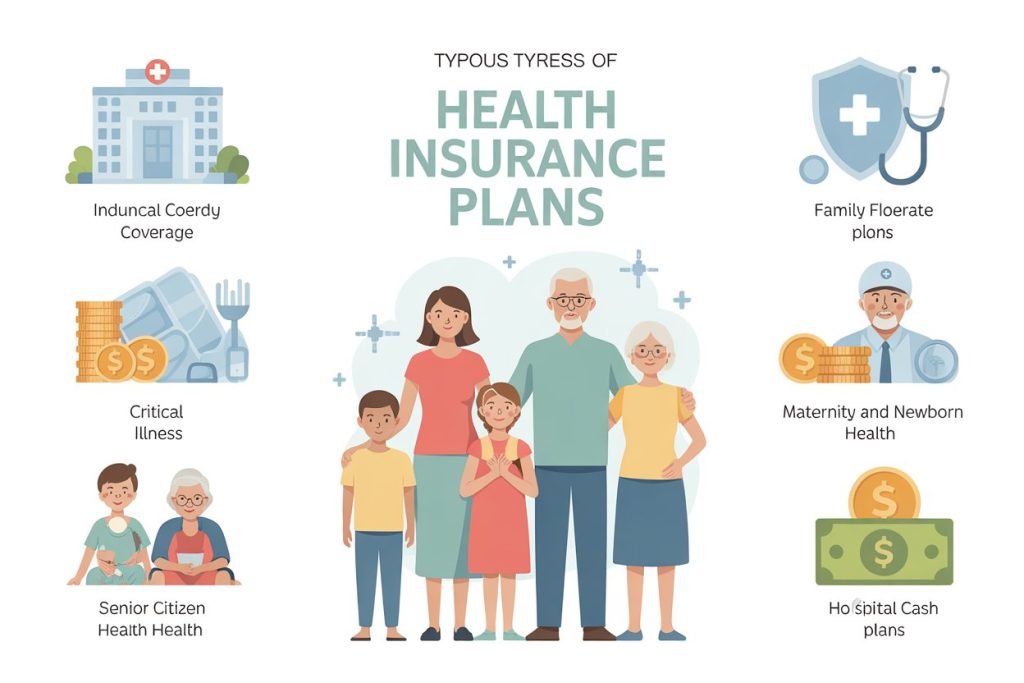

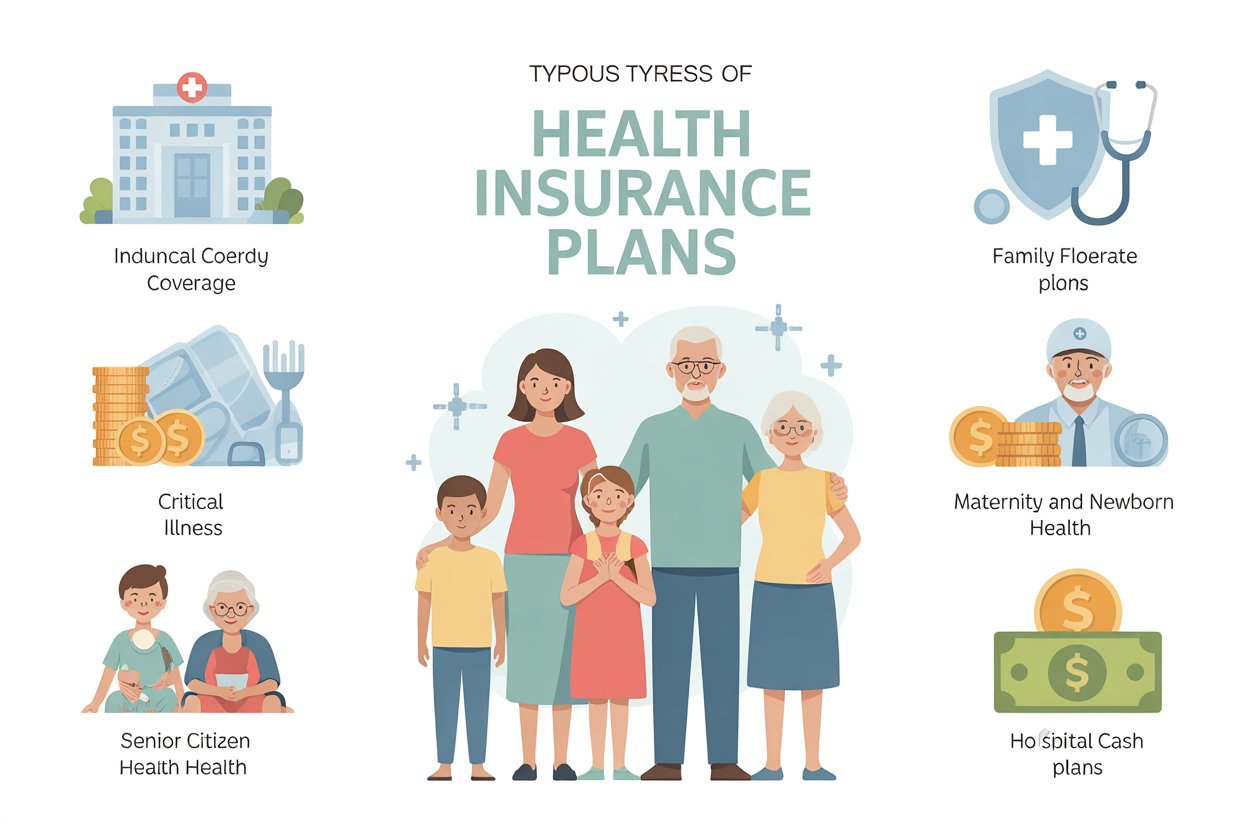

Health insurance is essential for protecting yourself and your family from unexpected medical expenses. However, not all health insurance plans are the same. Understanding the types of plans available can help you choose the one that fits your needs perfectly.

1. Individual Health Insurance

This plan provides coverage for a single person. It is ideal for young professionals or individuals without dependents. It covers hospitalization, doctor visits, surgeries, and sometimes outpatient treatments.

2. Family Floater Insurance

A family floater plan covers all members of a family under a single policy. Instead of buying separate policies for each member, a floater plan shares the sum insured among all family members. This is cost-effective and convenient for families.

3. Critical Illness Insurance

Critical illness insurance provides a lump sum payout if diagnosed with life-threatening conditions like cancer, heart attack, kidney failure, or stroke. The payout can cover treatment costs, lifestyle changes, and rehabilitation expenses.

4. Maternity and Newborn Insurance

This type of health insurance covers maternity-related expenses, including prenatal, postnatal care, and delivery. Some plans also cover newborn medical expenses, making it ideal for growing families.

5. Senior Citizen Health Insurance

Specifically designed for people aged 60+, these plans cover age-related health issues, including chronic illnesses and hospitalization. Premiums may be higher, but they provide essential financial protection for older adults.

6. Hospital Cash Plans

Hospital cash plans provide a fixed daily cash allowance for each day of hospitalization. This can help cover additional expenses like transportation, food, or caregiver costs.

Benefits of Choosing the Right Plan

- Financial Security: Protects you from high medical bills.

- Access to Quality Care: Ensures timely treatment at reputable hospitals.

- Preventive Benefits: Some plans include wellness programs, check-ups, and vaccinations.

- Peace of Mind: Reduces stress during medical emergencies.

Tips for Choosing the Best Health Insurance

- Compare multiple plans to find the best coverage for your needs.

- Check network hospitals and ensure they include your preferred providers.

- Understand exclusions, co-pays, and deductibles to avoid surprises.

- Consider add-on riders for maternity, critical illness, or dental coverage.

Conclusion

Choosing the right health insurance plan requires research and careful evaluation. By understanding the types of plans available and assessing your needs, you can ensure financial protection and access to quality healthcare for yourself and your family.